Table of Contents

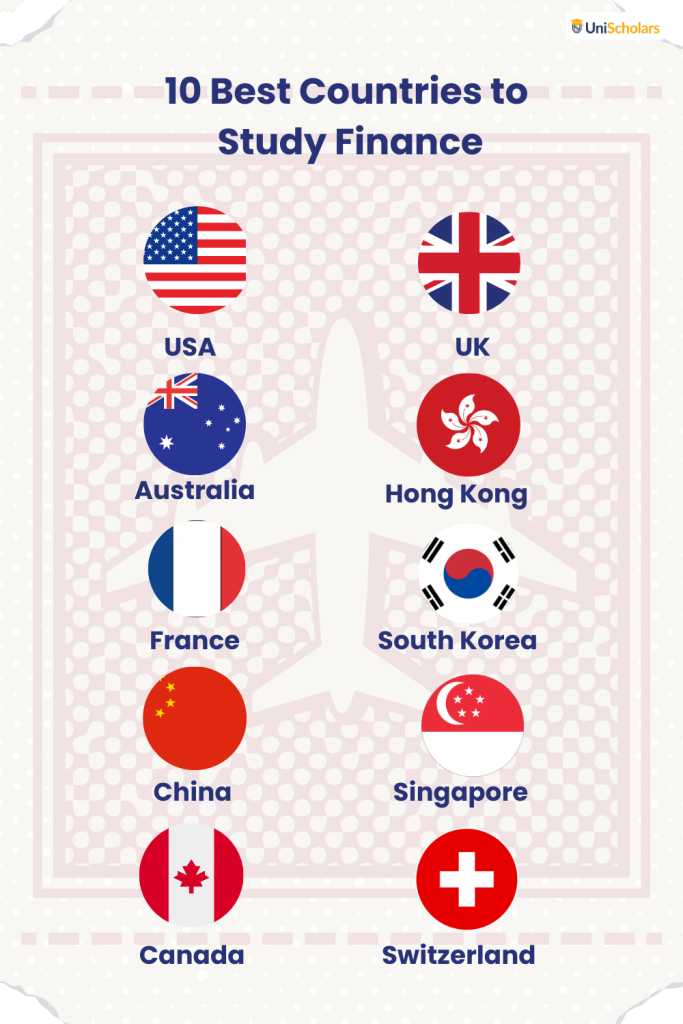

ToggleFinance careers no longer belong to one country or one market. With global demand rising across banking, fintech, accounting, and analytics, finance has become one of the most internationally mobile and in-demand career paths today. Financial analyst roles alone are projected to grow 6% between 2024 and 2034 in the US, reflecting a wider global need for skilled finance professionals. As a result, students are increasingly looking beyond their home countries for better exposure, stronger credentials, and long-term career outcomes.

However, rising tuition costs and endless study options make choosing wisely critical. This raises an important question: which are the best countries to study Finance when you balance quality, cost, global exposure, and employability? In this blog, we break down the top 10 destinations to help you decide.

| Country | Key USPs | Top Universities |

| United States of America | World’s largest financial market • Elite business schools • Strong internships & co-op culture • High long-term earning potential • Global finance hubs like New York, Boston, Chicago | Harvard University MIT Stanford University University of Chicago University of Pennsylvania (Wharton) Columbia University NYU |

| United Kingdom | London as a global finance hub • 1-year Master’s = faster ROI • Globally recognised degrees • Strong post-study work route • Close alignment with CFA/ACCA/CIMA | University of Oxford University of Cambridge London School of Economics Imperial College London London Business School |

| Canada | Stable global banking system • Strong co-op & internship pathways • Up to 3-year post-study work permit • High employability in finance & accounting • Immigration-friendly | University of Toronto University of British Columbia McGill University |

| Australia | Asia–Pacific market exposure • Industry-aligned finance curriculum • CPA/CA/CFA exemptions • Strong post-study outcomes • Finance roles on skilled occupation lists | University of Melbourne University of Sydney UNSWMonash University Australian National University |

| Singapore | Asia-Pacific finance gateway • Strong regulatory framework • High employability across ASEAN • Fintech and wealth management hub • Industry-first learning | National University of Singapore (NUS) Nanyang Technological University (NTU) Singapore Management University (SMU) |

| Hong Kong | Gateway to China markets • Top global financial centre • Strong banking & capital markets exposure • High employer recognition across Asia | University of Hong Kong HKUST Chinese University of Hong Kong |

| France | Elite Grandes Écoles • Strong EU finance access • Paris as a major capital market • Flexible cost options • Strong consulting & IB pipelines | HEC Paris INSEADESSEC Business School Université PSL |

| Switzerland | Global hub for wealth & asset management • Strong risk & compliance focus • Highly credible finance degrees • High salaries • Zurich & Geneva finance hubs | ETH Zurich University of St. Gallen University of Zurich |

| China | Rapidly growing financial power • Strong quantitative focus • Cost-effective education • Fintech & digital finance leadership • Generous scholarships | Peking University Tsinghua University Fudan University Shanghai Jiao Tong University |

| South Korea | Strong corporate economy • Growing fintech ecosystem • High academic standards at lower cost • Gateway to East Asian markets | Seoul National University Korea University Yonsei University KAIST |

This Quora thread features students discussing some of the best Master’s in Finance degrees abroad, sharing insights on universities, courses, and career outcomes.

10 Best Countries to Study Finance: Detailed Profiles for 2026

1. United States Of America

The United States of America is one of the world’s strongest destinations for finance, making it a preferred choice for students who want to study in the US. When considering the best countries to study finance, the US stands out for its elite business education, deep capital markets, and direct access to major financial hubs such as New York, Boston, Chicago, and San Francisco. As a global centre for investment banking, asset management, fintech, and corporate finance, the US offers unmatched exposure to internships, professional networks, and long-term career mobility.

Key Highlights

| Top Universities | #1 Harvard University #2 Massachusetts Institute of Technology (MIT) #3 Stanford University #5 University of Chicago #7 University of California, Berkeley (UCB) #9 University of Pennsylvania #10 Yale University #11 New York University (NYU) #12 Columbia University #14 University of California, Los Angeles (UCLA) |

| Average Cost of Studying | UG (Bachelor’s): USD 20,000–50,000 per yearPG (Master’s): USD 15,000–40,000 per year |

| Key Intakes | August – September (Fall)January (Spring) |

| Country-specific eligibility criteria | Undergraduate: Grades 9–12 transcripts; strong Math/Econ preferred, TOEFL/IELTS/Duolingo, SAT/ACT mostly test-optional. Postgraduate: Bachelor’s degree (quant background preferred), TOEFL ~100 / IELTS ~7.0, GMAT/GRE (program-specific), SOP/LOR/CV |

| Top Scholarship Opportunities | Fulbright Foreign Student ProgramUniversity & Program-Specific Merit ScholarshipsMPOWER Financing ScholarshipsBusiness School/Program ScholarshipsInternational Graduate Scholarships at Specific Institutions |

Why Study Finance in the United States of America?

- Global Leader in Finance Education

The US has 20+ universities in the global top 100 for Accounting & Finance (QS World University Rankings by Subject 2025), more than any other country, making it a prime choice among the best countries to study finance.

- World’s Largest Financial Market

The US hosts the world’s most influential financial markets, with a dominant share of global equity market capitalisation and deep, highly liquid capital markets that shape global investment flows.

- Strong Employment Demand for Finance Graduates

According to the US Bureau of Labor Statistics, finance-related roles such as financial analysts and accountants are expected to grow steadily through 2032, driven by corporate expansion and financial planning needs.

- High Long-Term Earning Potential

Median salaries for core finance roles in the US range between USD 79,000–100,000 per year, with income increasing significantly with experience, certifications, and firm type.

- Extensive Internship and Practical Exposure

US universities place strong emphasis on internships, co-op programs, and industry projects, giving students early exposure to real-world finance environments before graduation.

Career Opportunities Post a Finance Degree in United States of America

| Role | Typical Entry-Level Salary (USD) | Career Outlook |

| Financial Analyst | 65,000 – 75,000 | Strong demand in corporate finance, FP&A, and investment research |

| Investment Analyst | 70,000 – 85,000 | Pathway to asset management, equity research, and portfolio roles |

| Accountant / Auditor | 55,000 – 65,000 | Stable demand across industries; strong growth with CPA |

2. United Kingdom

For students considering studying in the UK, the country stands out as one of the best countries to study finance. It combines globally ranked universities with direct access to a mature financial ecosystem led by London, consistently ranked among the top global financial centres. The UK hosts a strong fintech ecosystem, and places multiple universities in the QS global rankings for Accounting & Finance, making it a high-ROI choice for international finance careers.

Key Highlights

| Top Universities | #4 University of Oxford #6 University of Cambridge #8 The London school of economics and political sciences #18 London Business school #21 Imperial college London #23 The University of Manchester #44 The University of Warwick #46 UCL #49 The University of Edinburgh |

| Average Cost of Studying | UG: £11,400 – £38,000 PG: £17,000 – £22,000 |

| Key Intakes | September (Autumn)January (Winter) |

| Country-specific eligibility criteria | UG: Class 10 + 12 completed; Maths preferred, 70–75% in 12th; IELTS/PTE (TOEFL/Duolingo at some universities). PG: Relevant Bachelor’s degree; IELTS/TOEFL/PTE; GMAT/GRE optional for top Finance programmes. |

| Top Scholarship Opportunities | Chevening Scholarships (UK government) Commonwealth Scholarships (typically PG; eligibility varies by country/course)GREAT Scholarships (British Council + partner universities; country/course-specific) Clarendon Fund (University of Oxford) |

Why Study Finance in the United Kingdom?

- Real proximity to the market

You’re studying Finance in an ecosystem where banks, funds, insurers, Big 4, and fintechs hire year-round great for internships, part-time roles (where permitted), and networking, making the UK one of the best countries to study finance.

- Career-ready curriculum options

Many UK universities offer Finance pathways tied to real-world specialisms—asset management, risk, fintech, corporate finance, analytics, and regulation.

- Faster ROI for Master’s

The UK’s common 1-year MSc structure can reduce total cost vs 2-year markets—without compromising on brand value or employer recognition.

- Globally recognised qualifications

UK finance degrees are highly regarded by employers worldwide and align well with professional certifications like ACCA, CFA, CIMA, giving graduates an edge in global roles.

- Strong post-study work pathway

The UK Graduate Route allows international students to stay back and work after graduation, giving real time to gain industry experience and convert roles into long-term careers.

Career Opportunities Post a Finance Degree in the United Kingdom

| Role | Typical Entry-Level Salary (USD) | Career Outlook |

| Financial Analyst | 60,000 – 75,000 | Strong demand in corporate finance, FP&A, and financial planning across UK firms |

| Accountant / Auditor | 50,000 – 65,000 | Consistent demand across industries; strong progression with ACA/ACCA/CIMA |

| Risk / Compliance Analyst | 55,000 – 70,000 | Growing need due to regulatory, AML, and risk management requirements |

| FinTech Analyst | 65,000 – 80,000 | High growth driven by London’s fintech ecosystem and digital finance adoption |

Compare top finance universities, explore the best countries, and get expert help with applications for the 2026 intake.

🌍 Explore Abroad Programs3. Australia

Australia is a leading destination for Finance studies and is considered one of the best countries to study finance. It is known for its globally ranked universities, transparent and well-regulated financial system, and strong links to Asia-Pacific financial markets. With Sydney and Melbourne ranked among the region’s key financial hubs, students benefit from industry-aligned education, strong employer recognition, and clear pathways into global finance, accounting, and fintech careers.

Key Highlights

| Top Universities | #22 The University of New South Wales #27 The University of Melbourne #29 The University of Sydney #41 Monash University #43 Australian National University #68 The University of Queensland |

| Average Cost of Studying | Undergraduate (UG): AUD 25,000 – 45,000Postgraduate (PG): AUD 30,000 – 50,000 |

| Key Intakes | February (Semester 1) – Primary intake July (Semester 2) – Secondary intake Some universities offer November intakes for select PG courses |

| Country-specific eligibility criteria | Undergraduate: Class 10 + 12 completed; Maths preferred; 60–75% in Class 12; IELTS 6.0–6.5 (PTE/TOEFL accepted).Postgraduate: Relevant Bachelor’s degree; IELTS/PTE/TOEFL; GMAT/GRE optional (mainly for competitive Finance/MBA programmes). |

| Top Scholarship Opportunities | Australia Awards Scholarships (Government-funded)Destination Australia ScholarshipUniversity Merit Scholarships (Melbourne, Monash, UNSW, etc.)Faculty-specific Business & Finance scholarships |

Also Read: Top-Ranked Universities in Australia You Should Know!

Why Study Finance in Australia?

- Asia–Pacific exposure

For students studying in Australia, the country’s position between Western and Asian economies offers direct exposure to Asia-Pacific capital markets, trade finance, and cross-border investment, an advantage for global finance careers.

- Industry-aligned education

Australian universities design Finance programmes around real-world case studies, data analysis, internships, and industry projects, ensuring graduates are job-ready from day one.

- Professional accreditation advantage

Many Finance and Accounting degrees are aligned with CPA Australia, CA ANZ, and CFA, allowing students to gain exemptions and fast-track professional certifications.

- Strong post-study outcomes

Finance and accounting roles regularly appear on Australia’s medium- to long-term skilled occupation lists, supporting strong employability and post-study work opportunities for international graduates, making Australia one of the best countries to study finance.

Career Opportunities Post a Finance Degree in Australia

| Role | Typical Entry-Level Salary (USD) | Career Outlook |

| Financial Analyst | 60,000 – 75,000 | Strong demand in corporate finance, planning & analysis |

| Accountant / Auditor | 55,000 – 70,000 | High demand; strong growth with CPA/CA qualification |

| Investment Analyst | 65,000 – 85,000 | Pathway to asset management and equity research |

| Risk / Compliance Analyst | 60,000 – 80,000 | Growing due to regulatory and financial risk needs |

| FinTech / Business Analyst | 65,000 – 90,000 | High growth driven by Australia’s digital finance sector |

4. Hong Kong

Hong Kong is one of the world’s most influential finance hubs, giving you direct exposure to banking, capital markets, asset management, and fintech, especially via its role as a gateway to Mainland China. It’s consistently ranked among the top global financial centres, which strengthens networking and early-career access while you study, making Hong Kong one of the best countries to study finance. Students also benefit from its dynamic regulatory environment, multinational financial firms, and opportunities to gain international experience in Asia’s fast-growing markets.

Key Highlights

| Top Universities | #28 The University of Hong Kong #34 The Hong Kong University of Science and Technology #37 The Chinese University of Hong Kong #57 The Hong Kong Polytechnic University #60 City University of Hong Kong |

| Average Cost of Studying | Undergraduate: HKD 140,000 – 249,000 per yearPostgraduate: HKD 100,000 – over 600,000 |

| Key Intakes | September January |

| Country-specific eligibility criteria | UG: Class 10 + 12 completed; Maths preferred; IELTS/TOEFL/PTE (university-specific).PG: Relevant Bachelor’s degree; IELTS/TOEFL/PTE; GMAT/GRE optional for select competitive programmes. |

| Top Scholarship Opportunities | Hong Kong PhD Fellowship Scheme (HKPFS): Fully funded PhD at UGC universities with an annual stipend of HKD 340,800 plus travel allowance.HKSAR Government Scholarship Fund: Up to HKD 80,000 per year for outstanding non-local UG and PG students, including targeted awards for Indian and ASEAN students.Belt and Road Scholarship: Covers full first-year tuition for selected UG and research PG students from eligible countries, including India. |

Why Study Finance in Hong Kong?

- International finance career exposure:

Hong Kong hosts major global banks, asset managers, and Big 4 firms, offering strong access to internships, analyst roles, and cross-border finance careers early on.

- Strong post-study employability:

Finance graduates benefit from Hong Kong’s talent-driven financial sector, where skills in finance, risk, compliance, and analytics are consistently in demand across banking and capital markets.

- China + Asia finance advantage:

Gain direct exposure to Greater China capital markets, cross-border banking, and Asia-Pacific investment flows, positioning graduates strongly for regional and global finance roles.

- High-signal academic credentials:

Hong Kong’s leading universities are highly regarded across Asia for Finance, offering programmes that integrate quantitative finance, financial markets, analytics, and regulation, skills valued by global employers.

Career Opportunities Post a Finance Degree in Hong Kong

| Role | Typical Entry-Level Salary (HKD / year) | Career Outlook |

| Financial Analyst | HKD 360,000 – 480,000 | Steady demand in corporate finance, FP&A, and MNCs |

| Investment Analyst | HKD 420,000 – 600,000 | Competitive entry; strong progression into buy-side and research roles |

| Accountant / Auditor | HKD 300,000 – 420,000 | Consistent hiring via Big 4; rapid growth with CPA/ACCA |

| Risk / Compliance Analyst | HKD 360,000 – 520,000 | Growing demand due to AML, regulatory, and risk controls |

| FinTech / Business Analyst | HKD 420,000 – 600,000 | Strong growth driven by digital banking and fintech expansion |

5. France

France stands out for Finance studies through its elite Grandes Écoles, strong academic rigour, and Paris’s position as a major European financial centre. With deep links to capital markets, consulting, luxury and corporate finance, France offers students a high-credibility pathway into pan-European and global finance careers, making it one of the best countries to study finance. Students also benefit from growing fintech and sustainability-focused finance roles, as well as access to employers across the wider EU market.

Key Highlights

| Top Universities | #24 HEC Paris #42 INSEAD #75 Universite PSL #86 ESSEC Business school #93 Universite Paris 1 Pantheon – Sorbonne |

| Average Cost of Studying | Undergraduate: €2,850 – €18,000/yearPostgraduate: €3,879 – €45,900/ Year |

| Key Intakes | Undergraduate and Postgraduate : September/October |

| Country-specific eligibility criteria | UG: Class 10 + 12 completed; strong Class 12 (Maths often preferred for Finance/Econ); IELTS/TOEFL/PTE. PG: Relevant Bachelor’s (Finance/Business/Econ; quant degrees may be considered); IELTS/TOEFL/PTE; GMAT/GRE recommended for competitive programmes. |

| Top Scholarship Opportunities | France Excellence Eiffel Scholarship (Masters/PhD)Émile Boutmy Scholarship (Sciences Po) (for non-EU students; UG + Master’s) University/School merit scholarships |

Why Study Finance in France?

- High-signal business schools

France’s Grandes Écoles are globally respected for Finance, with deep corporate linkages and strong placement pipelines into consulting, investment banking, luxury finance, and EU institutions.

- Capital markets exposure

Paris hosts Euronext Paris with 800+ listed companies, giving students real exposure to equity markets, derivatives, and corporate finance ecosystems, especially relevant for valuation and markets-focused roles.

- Cost flexibility and ROI choice

France offers a unique cost spectrum: low-cost public universities for value-driven students, and premium business schools for those targeting high-brand ROI, allowing clear financial planning upfront.

- EU career access

Studying in France places students within the EU finance job market, enabling access to opportunities across France, Luxembourg, Belgium, Germany, and the Netherlands, subject to employer and visa rules.

Also Read: France Student Visa: Requirements, Fees & Application Process

Career Opportunities Post a Finance Degree in France

6. South Korea

South Korea is an emerging destination for Finance studies and is increasingly recognised as one of the best countries to study finance. It combines high-quality education with a fast-growing financial and fintech ecosystem, alongside strong links to Asia-Pacific markets. With Seoul as a major regional business hub, students gain exposure to banking, corporate finance, technology-driven finance, and global trade.

Key Highlights

| Top Universities | #36 Seoul National University #50 Korea University #51 Yonsei University #53 KAIST – Korea Advanced Institute of Science and Technology |

| Average Cost of Studying | UG (Bachelor’s): USD 6,000 – 12,000 per yearPG (Master’s): USD 8,000 – 18,000 per year (Public universities) |

| Key Intakes | March (Spring) – Primary intakeSeptember (Fall) – Secondary intake |

| Country-specific eligibility criteria | Undergraduate: Grades 10–12 completed; Maths preferred; IELTS/TOEFL (waivers possible for English-medium study) Postgraduate: Relevant Bachelor’s degree; IELTS/TOEFL; GMAT/GRE for select programmes; SOP/CV/LOR. |

| Top Scholarship Opportunities | Global Korea Scholarship (GKS)University Merit Scholarships (SNU, Korea University, Yonsei, etc.)Korean Government & Foundation ScholarshipsProgramme-specific tuition waivers |

Why Study Finance in South Korea?

- Strong Corporate & Export-Driven Economy

South Korea is home to global conglomerates (Samsung, Hyundai, LG), creating strong demand for finance professionals in corporate finance, treasury, and strategy roles.

- Growing FinTech and Digital Finance Sector

The country is investing heavily in digital payments, blockchain, and fintech innovation, opening new-age finance career paths.

- High Academic Standards at Competitive Costs

Korean universities offer rigorous education at a lower tuition cost compared to the US or UK, improving ROI for international students.

- Asia-Focused Career Exposure

Studying in South Korea provides a gateway to East Asian and global markets, especially for students targeting Asia-Pacific finance roles.

Why Study Finance in South Korea ?

| Role | Typical Entry-Level Salary (KRW / year) | Career Outlook |

| Financial Analyst | ₩35,000,000 – ₩55,000,000 | Growing demand in corporates and multinational firms |

| Investment Analyst | ₩40,000,000 – ₩65,000,000 | Opportunities in securities firms and asset management |

| Accountant / Auditor | ₩30,000,000 – ₩50,000,000 | Stable demand; strong growth with CPA/ACCA |

| Risk / Compliance Analyst | ₩38,000,000 – ₩60,000,000 | Rising need due to regulatory and governance focus |

| FinTech / Business Analyst | ₩45,000,000 – ₩70,000,000 | High growth driven by digital finance and fintech expansion |

7. China

China has quickly positioned itself as a leading destination for finance education and is increasingly seen as one of the best countries to study finance. Supported by its strong analytical academic culture, state-driven economic expansion, and growing integration with global markets, China offers students exposure to major financial hubs such as Shanghai, Beijing, Shenzhen, and Hong Kong, with first-hand experience in banking, investment, fintech, and international trade finance within the world’s second-largest economy.

Key Highlights

| Top Universities | #14 Peking University #16 Tsinghua University #37 Fudan University #40 Shanghai Jiao Tong University #66 Zhejiang University #74 Renmin (People’s) University of China |

| Average Cost of Studying | UG (Bachelor’s): USD 4,000–10,000 per yearPG (Master’s): USD 5,000–15,000 per year |

| Key Intakes | September (Primary Intake)March (Limited programs) |

| Country-specific eligibility criteria | Undergraduate: Grades 9–12 transcripts; strong Mathematics background preferred · IELTS/TOEFL (some universities accept English-medium schooling proof) · Entrance exams generally not required for international students Postgraduate: Bachelor’s degree (Finance/Economics/Engineering/Math preferred) · IELTS ~6.5 / TOEFL ~90 · GMAT/GRE optional (top universities/programs specific) · SOP/CV/LORs |

| Top Scholarship Opportunities | Chinese Government Scholarship (CSC)Belt and Road ScholarshipShanghai Government ScholarshipUniversity-Specific Merit & Excellence ScholarshipsConfucius Institute Scholarships (select programs) |

Why Study Finance in China?

- Rapidly Growing Global Financial Power

China plays a central role in the global economy and continues to strengthen its financial markets at scale. Major cities such as Shanghai and Shenzhen consistently rank among the world’s top financial centres, providing students with proximity to capital markets, commercial banking, fintech ecosystems, and international trade.

- Strong Universities with Quantitative Focus

Chinese universities are particularly respected for their rigorous training in mathematics, economics, data analytics, and finance. Leading institutions such as Tsinghua University and Peking University regularly feature in global rankings for business and economics, reflecting strong academic outcomes and research excellence.

- Cost-Effective Education with High ROI

Studying finance in China is considerably more affordable than in many Western countries. Tuition and living expenses are lower, and a wide range of government- and university-funded scholarships often cover tuition, accommodation, and living stipends, making it a high-return investment for international students.

- Exposure to Fintech and Digital Finance

China is at the forefront of global fintech innovation, with leadership in digital payments, AI-powered finance, blockchain applications, and large-scale financial platforms. Students benefit from exposure to ecosystems shaped by organisations such as Ant Group, Tencent, and central state-owned banks.

- Strong Demand for Finance Talent

As China continues to expand its role in global trade, investment, and financial services, demand for finance professionals remains strong. International organisations such as the World Bank and IMF highlight consistent opportunities across corporate finance, risk management, auditing, and global business functions.

Career Opportunities Post a Finance Degree in China

| Role | Typical Entry-Level Salary (CNY / year) | Career Outlook |

| Financial Analyst | 180,000 – 300,000 | Growing demand in corporates, SOEs, and multinational firms |

| Investment Analyst | 220,000 – 360,000 | Strong opportunities in asset management, securities firms, and private equity |

| Accountant / Auditor | 140,000 – 260,000 | Stable demand; strong growth with CPA / ACCA / CICPA certifications |

8. Singapore

Singapore is one of Asia’s leading finance destinations and is widely regarded as one of the best countries to study finance. It is recognised globally for its strong regulatory framework, stable economy, and world-class financial institutions. As a major Asia-Pacific financial hub and home to top-ranked universities, it offers Finance students high-quality education with direct exposure to banking, wealth management, fintech, and regional capital markets.

Key Highlights

| Top Universities | #12 National University of Singapore #20 Nanyang Technological University #64 Singapore Management University |

| Average Cost of Studying | Undergraduate: SGD 30,000 – 45,000Postgraduate: SGD 35,000 – 60,000 |

| Key Intakes | August (Primary)January (select PG) |

| Country-specific eligibility criteria | UG: Class 10 + 12 completed; Maths required/preferred; 75–90% in Class 12; IELTS 6.5–7.0 (TOEFL/PTE accepted). PG: Relevant Bachelor’s degree; IELTS/TOEFL/PTE; GMAT/GRE often required/recommended for competitive Finance/MBA programmes. |

| Top Scholarship Opportunities | ASEAN Scholarships (select UG pathways)NUS / NTU / SMU Merit ScholarshipsLee Kong Chian Graduate ScholarshipsUniversity-specific Business & Finance scholarships |

Why Study Finance in Singapore?

- Asia-Pacific finance gateway

Singapore sits at the centre of Asia’s financial ecosystem, giving students direct exposure to ASEAN economies, China-linked markets, and global capital flows—a strong advantage for international finance careers.

- Globally trusted regulatory environment

Known for its robust regulation and financial stability, Singapore offers a real-world learning ground for risk management, compliance, and governance-focused finance roles.

- Industry-first learning approach

Finance programmes are closely aligned with industry needs, combining data analytics, fintech applications, case-based learning, and hands-on projects to build job-ready skills.

- High employability across Asia

Degrees from Singapore’s universities are widely recognised across Asia, opening doors to careers in banking, consulting, wealth management, and fintech across regional and global firms.

Career Opportunities Post a Finance Degree in Singapore

| Role | Typical Entry-Level Salary (SGD / year) | Career Outlook |

| Financial Analyst | 55,000 – 70,000 | Strong demand in corporates, banks, and MNCs |

| Investment Analyst | 65,000 – 90,000 | Competitive entry; growth into asset & portfolio management |

| Accountant / Auditor | 45,000 – 60,000 | Stable hiring; strong progression with CPA/ACCA |

| Risk / Compliance Analyst | 55,000 – 80,000 | High demand due to regulatory and governance needs |

| FinTech / Business Analyst | 60,000 – 90,000 | Rapid growth driven by Singapore’s fintech ecosystem |

9. Canada

Canada is one of the most popular destinations for Finance studies and is widely regarded as one of the best countries to study finance. It combines globally ranked universities with a stable, well-regulated financial system and strong access to major finance hubs such as Toronto, Vancouver, and Montreal. The country is known for its leadership in banking, asset management, fintech, and risk management, offering clear academic-to-career pathways for international students.

Key Highlights

| Top Universities | #17 University of Toronto #34 University of British Columbia #56 McGill University |

| Average Cost of Studying | UG (Bachelor’s): CAD 20,000 – 45,000 per yearPG (Master’s): CAD 18,000 – 40,000 per year |

| Key Intakes | September (Fall) – Primary intakeJanuary (Winter) – Secondary intakeMay (Spring/Summer) – Limited programmes |

| Country-specific eligibility criteria | Undergraduate: Grades 10–12 transcripts; Maths strongly preferred · IELTS/TOEFL/PTE/Duolingo · SAT/ACT usually optional Postgraduate: Bachelor’s degree (Finance/Business/Economics or quantitative background) · IELTS ~6.5–7.0 / TOEFL ~90–100 · GMAT/GRE (programme-specific) · SOP/LOR/CV |

| Top Scholarship Opportunities | Vanier Canada Graduate ScholarshipsOntario Graduate Scholarship (OGS)University-specific merit scholarshipsBusiness school & programme-level scholarshipsInternational Entrance Scholarships |

Read More: Why Study Abroad In Canada?

Why Study Finance in Canada?

- Strong Global Banking System

Canada consistently ranks among countries with the most stable banking systems, making it a strong environment to study risk management, banking, and financial regulation.

- High Demand for Finance Professionals

According to Statistics Canada, finance and accounting roles continue to grow due to corporate expansion, regulatory needs, and financial planning demand.

- Post-Study Work & Immigration Pathways

Canada’s PGWP allows graduates to gain up to 3 years of work experience, supporting long-term career and immigration prospects.

- Industry-Integrated Education

Canadian universities emphasise internships, co-op programmes, case-based learning, and industry projects, giving students early exposure to real finance roles.

- Competitive Long-Term Earnings

Finance professionals in Canada enjoy strong salary growth, especially with experience and certifications like CPA or CFA.

Career Opportunities Post a Finance Degree in Canada

| Role | Typical Entry-Level Salary (CAD) | Career Outlook |

| Financial Analyst | 60,000 – 75,000 | Strong demand in corporate finance, FP&A, and analytics |

| Investment Analyst | 65,000 – 85,000 | Growth in asset management, wealth management, and research |

| Accountant / Auditor | 50,000 – 65,000 | Stable demand; strong progression with CPA Canada |

| Risk / Compliance Analyst | 60,000 – 80,000 | Rising demand due to regulatory and governance needs |

| FinTech / Business Analyst | 65,000 – 90,000 | High growth driven by Canada’s fintech and digital banking sector |

10. Switzerland

Switzerland is a leading destination for Finance studies and is widely regarded as one of the best countries to study finance. Known for its strong banking heritage, financial stability, and global reputation in wealth and asset management, the country offers close academic and industry integration across banking, private wealth, commodities trading, and risk management, supported by finance hubs such as Zurich and Geneva.

| Top Universities | #47 ETH Zurich #81 University of Zurich #86 University of St Gallen |

| Average Cost of Studying | Undergraduate: CHF 900 – 4,200/yearPostgraduate: CHF 900 – 4,000 per year (Public universities) |

| Key Intakes | September (Fall) – Primary intake February (Spring) – Available for select programmes |

| Country-specific eligibility criteria | Undergraduate: Grades 9–12 transcripts; Maths strongly preferred · IELTS/TOEFL · Some universities may require entrance exams Postgraduate: Bachelor’s degree (Finance/Business/Economics or quantitative background) · IELTS ~6.5–7.0 / TOEFL ~90+ · GMAT/GRE may be required for competitive programmes · SOP/LOR/CV |

| Top Scholarship Opportunities | Swiss Government Excellence ScholarshipsUniversity of St. Gallen Merit ScholarshipsETH Zurich Excellence ScholarshipsProgramme-specific business school scholarships |

Why Study Finance in Switzerland?

- Global Hub for Wealth & Asset Management

Switzerland manages a significant share of global cross-border private wealth, making it one of the best countries for masters in finance, especially for careers in private banking, asset management, and financial advisory.

- Strong Regulatory & Risk Framework

The Swiss financial system is globally respected for compliance, transparency, and risk management, providing a solid foundation for modern finance careers.

- High-Quality, Research-Driven Education

Swiss universities combine academic rigour with applied finance, especially in areas like quantitative finance, banking, and financial economics.

- Strong Long-Term Career Value

Swiss finance degrees carry high international credibility, supporting careers across Europe and global financial centres.

Career Opportunities Post a Finance Degree in Switzerland

| Role | Typical Entry-Level Salary (CHF / year) | Career Outlook |

| Financial Analyst | 75,000 – 90,000 | Strong demand across banks, corporates, and consulting |

| Investment / Wealth Analyst | 80,000 – 100,000 | Growth in private banking and asset management |

| Accountant / Auditor | 70,000 – 85,000 | Stable demand; strong progression with CPA/ACCA |

| Risk / Compliance Analyst | 80,000 – 100,000 | High demand driven by strict regulatory standards |

| Commodities / Trading Analyst | 85,000 – 110,000 | Strong opportunities in Geneva and Zurich trading hubs |

How to Choose the Right Country to Study Finance

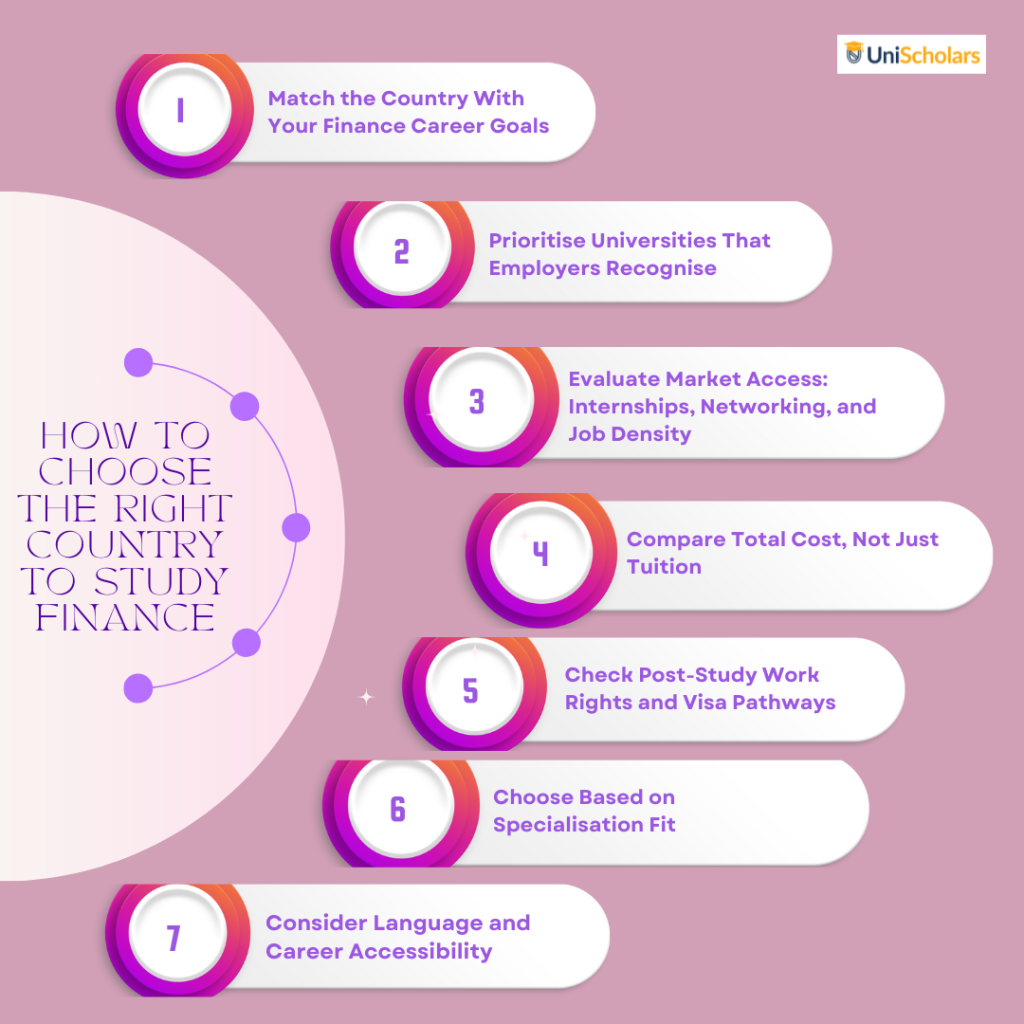

Choosing the right country to study finance isn’t about picking the highest-ranked destination. It’s about finding the best fit for your career goals, budget, work opportunities, and long-term plans. A finance degree delivers the most value when it combines strong academic credibility with real market exposure, clear post-study options, and the right specialisation.

1. Match the Country With Your Finance Career Goals

Different destinations lead in different finance domains. If you’re targeting investment banking, asset management, or consulting, countries with major global finance hubs and strong recruiter presence typically offer the best exposure. If you’re more interested in fintech, analytics, or digital finance, look for countries with fast-growing innovation ecosystems and strong employer demand in those areas. Your goal should be to study where your target roles and employers are most active.

2. Prioritise Universities That Employers Recognise

Rankings matter in finance because employer trust is strongly tied to institutional reputation. Use QS, THE, and FT rankings as a starting filter, but also evaluate programme quality through curriculum depth (quant, data, markets), faculty credibility, industry partnerships, and alumni outcomes. A slightly lower-ranked university in a strong finance hub can sometimes outperform a higher-ranked university in a weaker job market.

3. Evaluate Market Access: Internships, Networking, and Job Density

Finance is network-driven. Countries with strong banking, capital markets, consulting, Big 4, and fintech ecosystems typically provide more internship pipelines, part-time opportunities (where permitted), industry events, and campus hiring. Look for locations where students can realistically build experience during the degree, not only after graduation.

4. Compare Total Cost, Not Just Tuition

Tuition is only one part of the investment. Living expenses, accommodation, health insurance, commuting, and visa costs can significantly change the total outlay especially in expensive finance hubs. Compare total annual cost against realistic graduate outcomes in that country, including salary ranges, job availability, and the time it typically takes to land a role. The best ROI often comes from a balanced mix of affordability and employability.

5. Check Post-Study Work Rights and Visa Pathways

Post-study work options can strongly influence career outcomes, especially if you want international experience after graduation. Prioritise countries with clear graduate work routes and realistic pathways to stay and work. Even a great programme can lose value if work authorisation is restrictive or short, limiting your ability to convert internships into full-time roles.

6. Choose Based on Specialisation Fit

Finance is broad corporate finance, investment banking, wealth management, risk, fintech, sustainable finance, and quantitative finance require different strengths. Choose countries known for your focus area. For example, some destinations offer stronger access to global banks and markets roles, while others provide a faster path into fintech, risk, or compliance. Align your country choice with the kind of finance you want to build a career in.

7. Consider Language and Career Accessibility

Many European and Asian destinations offer English-taught finance degrees, but local language can still affect internships, networking, and job options. If your goal is to work in that country post-study, consider whether language will limit your role options, client-facing work, or long-term progression. The best destination is one where you can access opportunities both inside and outside the classroom.

8. Don’t Ignore Lifestyle and Personal Fit

Your academic performance and career outcomes are influenced by your environment. Safety, culture, weather, city pace, cost of living, and support systems matter more than students expect. Studying in a country where you can adapt quickly and stay mentally comfortable can improve grades, confidence, networking, and overall productivity especially in a demanding field like finance.

Wrapping Up

There’s no single “best country” to study finance abroad. The right choice depends on your personal goals, budget, career ambitions, and long-term plans. What works for a student targeting global banking exposure may differ from someone prioritising affordability, post-study work options, or lifestyle fit. That’s why, when comparing the best countries to study finance, a balanced approach is essential. Evaluate course quality, tuition and living costs, job market strength, lifestyle, and visa regulations together rather than in isolation.

If you are unsure where to begin, UniScholars can help simplify the process. From personalised counselling and course-university matching to application support and visa guidance, UniScholars ensures you make a well-informed decision that aligns with your academic and career goals.

Explore top countries, universities, and finance programs for 2026. Get expert guidance on shortlisting, scholarships, and applications—all in one place.

🌍 Explore Finance Programs AbroadFrequently Asked Questions

Ans: The best places to study finance are countries with strong financial hubs and top universities, such as the USA, UK, Singapore, Switzerland, and France, where students gain both academic excellence and real market exposure.

Ans: Roles like Investment Banking Managing Director, Private Equity Partner, and Hedge Fund Manager are among the highest paid in finance, with compensation rising significantly through bonuses and carried interest.

Ans: Top universities for finance include Harvard, MIT, Stanford, London School of Economics, HEC Paris, University of St. Gallen, NUS, and Oxford, all known for strong employer recognition and placements.

Ans: The USA, UK, France, Switzerland, Singapore, and the Netherlands are among the best countries for a Master’s in Finance due to strong curricula, industry access, and post-study opportunities.

Ans: Yes, the UK is one of the best destinations for a Master’s in Finance, offering world-ranked universities, strong employer recognition, and direct access to London’s global financial market, making it ideal for finance careers in banking, consulting, and fintech.

1 thought on “Top PGDM Courses In Canada: Universities & Eligibility”

I have done Bachelor’s in Culinary Arts from India and completed my graduation in the year 2022 .I am 22 years old. After graduation, I have done 1 year paid internship from USA .Now, I would like to take occupational experience and learn culinary skills and also do masters in Culinary arts.How can I find the college n best course / country where I can persue studying further